NEW CONSTRUCTION OR RESALE...Why More Buyers Are Choosing New Construction—and How to Make It Work for You!

Why More Buyers Are Choosing New Construction—and How to Make It Work for You Have you noticed more friends talking about buying brand-new homes lately? You’re not imagining things—new construction is catching the eye of more buyers than ever. As your trusted Texas Hill Country luxury Realtor, I’m e

North San Antonio & Hill Country Real Estate Market Trends: Q1 2025 Analysis

I get asked ALL THE TIME… “How’s the market?” It’s really a loaded question because my follow up question is “What market?” What specific area or pricepoint is this person asking about and are they looking at a primary home, cash flowing investment or short term or long term ROI? The bottom line is

Has San Antonio Become Texas’s Luxury Real Estate Hotspot for High Net-Worth Buyers?

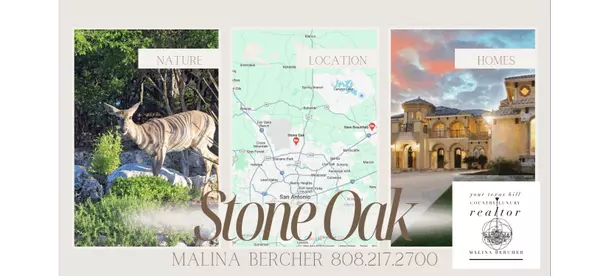

San Antonio: Texas’s Luxury Real Estate Hotspot for High Net-Worth Buyers In recent years, San Antonio has gained traction as one of the most desirable locations for high-net-worth individuals looking to relocate. Combining world-class amenities with Texas Hill Country charm, North San Antonio and

Timing the Market: How Waiting for Lower Rates Could Leave You Behind in the Home Buying Race!

When you’re thinking about buying a house, many people wait for the Federal Reserve (the Fed) to lower interest rates because lower rates usually mean lower mortgage payments. However, there are a few reasons why waiting might not be the best idea: T-Bills vs. Fed Rates: Treasury bills (T-bills) oft

Categories

Recent Posts